Pressure on the Bank of England to pause interest rate hikes is building after official figures showed a surprise easing of UK inflation last month.

Business groups have joined the calls on policymakers to keep interest rates as they are ahead of the latest decision, due to be announced on Thursday.

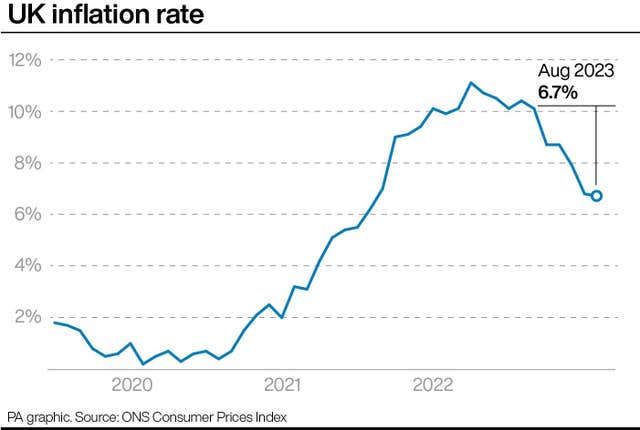

It comes after the rate of Consumer Prices Index (CPI) fell to 6.7% in August, down from 6.8% in July, and the lowest rate since February last year.

Analysts, and the Bank of England, had predicted inflation to accelerate last month to a reading of 7.1% due to a sharp rise in motor fuel amid a rebound in oil prices.

But a slowdown in food price inflation, as well as falling restaurant and hotel prices, helped offset rising petrol and diesel costs, the Office for National Statistics (ONS) said.

The new inflation data prompted market expectations over whether the Bank will raise interest rates to 5.5% on Thursday, from the current level of 5.25%, to shift.

An 80% expectation of rates rising fell to around 50% after the figures were released, AJ Bell said, indicating that analysts are divided over how the Monetary Policy Committee (MPC) could vote.

Suren Thiru, the economics director for chartered accountant group ICAEW, said raising interest rates would be a “misstep” following the surprise inflation fall.

He said: “This surprising drop in inflation suggests that the UK is winning the battle against soaring prices.

“Although interest rates will probably rise on Thursday, additional tightening unnecessarily risks aggravating the financial struggles facing households and businesses, given the long time lag between rate hikes and their impact on the real economy.”

The Federation of Small Businesses (FSB) agreed that Thursday’s decision must mark a peak for UK interest rates.

Martin McTague, the FSB’s national chairman, said: “With signs that interest rate rises are starting to bite, tomorrow’s base rate decision by the Bank of England has to be the peak for rates, one way or another.

“Leaving rates high for longer than needed will devastate the chances of an economic recovery.”

Paul Nowak, trade union TUC’s general secretary, said a halt to rate rises is “long overdue”, adding: “Pushing interest rates so high that the economy is driven into recession will only make the current crisis worse, costing people their jobs and their homes.”

Nevertheless, some economists think that the Bank could vote for a hike because it will pay attention to other important factors, such as wage growth and services inflation which remain elevated.

Policymakers could also want firmer signs that underlying inflation is on the descent, especially with the recent surge in oil prices amid production cuts in Russia and Saudi Arabia.

Chancellor Jeremy Hunt claimed the fall in the CPI rate shows “the plan to deal with inflation is working – plain and simple”.

He added: “But it is still too high which is why it is all the more important to stick to our plan to halve it so we can ease the pressure on families and businesses.

“It is also the only path to sustainably higher growth.”

The Government in January pledged to halve inflation from 10.7% to around 5.3% by the end of the year.

Food prices increased to 13.6% in August against the same month last year, easing back from 14.9% growth in July, with the largest falls coming from milk, cheese, eggs, vegetables and fish.

It means that UK consumers still face climbing prices in supermarkets as food inflation remains well in double digits.

Meanwhile, the average price of petrol rose by 5.3p per litre between July and August – compared with a much sharper drop in prices last year from a record high in July 2022.

The latest figures also showed the CPI measure of inflation including housing costs (CPIH) fell to 6.3% in August, down from 6.4% in July.

The Retail Prices Index inflation rate was 9.1% in August, up from 9% in July.

Grant Fitzner, the ONS’s chief economist, said: “The rate of inflation eased slightly this month driven by falls in the often-erratic cost of overnight accommodation and air fares, as well as food prices rising by less than the same time last year.”

Why are you making commenting on The National only available to subscribers?

We know there are thousands of National readers who want to debate, argue and go back and forth in the comments section of our stories. We’ve got the most informed readers in Scotland, asking each other the big questions about the future of our country.

Unfortunately, though, these important debates are being spoiled by a vocal minority of trolls who aren’t really interested in the issues, try to derail the conversations, register under fake names, and post vile abuse.

So that’s why we’ve decided to make the ability to comment only available to our paying subscribers. That way, all the trolls who post abuse on our website will have to pay if they want to join the debate – and risk a permanent ban from the account that they subscribe with.

The conversation will go back to what it should be about – people who care passionately about the issues, but disagree constructively on what we should do about them. Let’s get that debate started!

Callum Baird, Editor of The National

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here